Funding a secure & Mobile Domestic Bundle

Whether or not similar, there are numerous key differences. Today we will manage old-fashioned home and home financing, what the processes to have financing are, and you will what the masters are when selecting your brand-new mobile family using this alternative.

What exactly is Residential property & A home loan?

When selecting a cellular family, you need to have some possessions to get brand new home into, if you don’t want to book in a cellular family community.

While some people are capable put their house on the family members property or talented home, anybody else will have to buy their residential property this new and can usually must put in the strength, h2o, and you will septic regarding scrape.

Opting for an area and you can a mortgage choice does not only roll the land and you may household buy towards one to mortgage however, also allow home upgrade will set you back is folded in too.

It indicates without in order to create most cash having your own foot mat, ount out-of money you qualify for as well as the count you have got available for the newest downpayment.

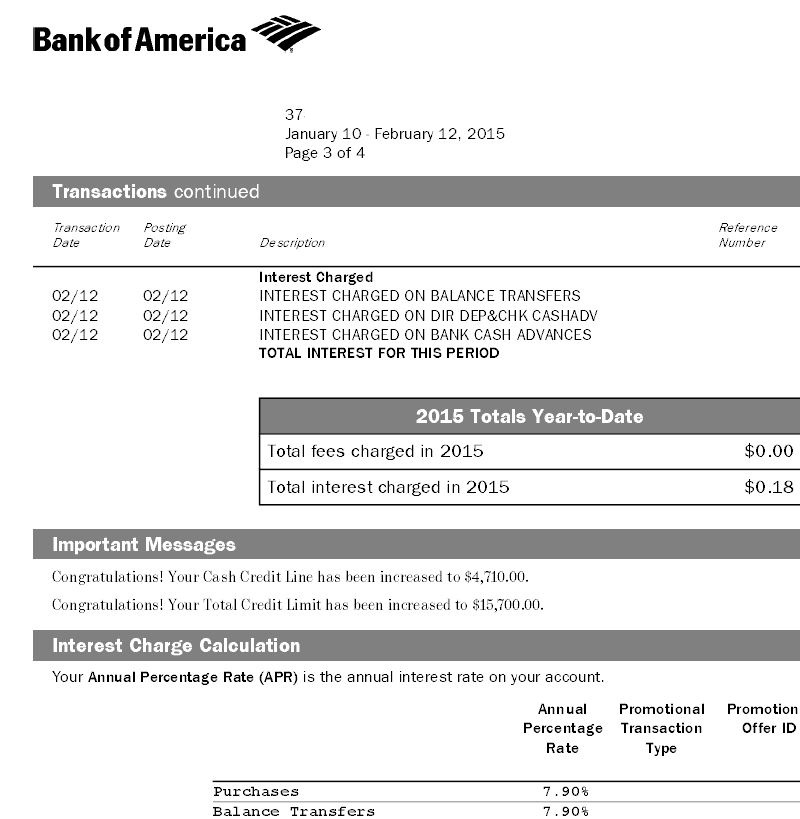

Supposed conventional, meaning the loan is not government recognized, their advance payment tend to typically slide ranging from 5-10% along with your interest rate might be at the mercy of the current market rates as opposed to the all the way down initial cost from an enthusiastic FHA otherwise Va mortgage. (Listen in for in the future once we discuss the benefits and you may disadvantages of your own regulators backed FHA, Virtual assistant, and you can USDA belongings and you can mortgage brokers.)

Why does Funding My personal Land and you may Cellular Home work

You need to have an idea of the price of end up in their address town while the price of the home you are looking for managing. Your homes consultant will also help having quotes to have house improvements necessary and you may/otherwise planned to include in extent submitted to the financial institution too.

The financing software should include information about your income, business background, and you will current residential position in fact it is verified on needed paperwork after a primary approval.

Immediately after searching an acceptance and you may taking the newest regards to the mortgage (down payment, interest, and you may loan amount) it could be time and energy to get a hold of your house and have this new webpages checked and you may researched to be sure its right for laying out a mobile household, is not inside a flood region, is on a main highway, and it has fairly available resources-brand new subsequent fuel and you will liquids is actually, the more expensive they’ll be to install.

Your website inspector may also assess charges for most other advancements you might want towards assets, for example home clearing, porches, skirting, if not an effective carport.

When you plan to build a deal Nebraska installment loans on a property and you can have the property contract and you can backup of your own newest user’s deed, you are going to fill out the house suggestions for the lender explaining the cost, taxation reputation for the fresh belongings, and you will a duplicate of the action regarding most recent residents.

The next phase is the latest appraisal. The financial institution costs a fee off $600 that is repaid straight from the client towards the financial ahead of they’re able to go ahead which have appraising new house and dealing right up the files that will push you to be this new closure dining table.

What takes place Once i Romantic on the Loan?

After you’ve closedsigned most of the records and you can offered down-paymentinto an area/home loan, your residence could well be purchased and you will built within warehouse when you are webpages advancements to arrange for the birth of the property often start.

Which have a normal mortgage, you don’t need to to employ just subscribed builders to complete the website work. It’s possible to have assistance from friends and family, do a bit of of one’s work oneself and you will finance the material, otherwise decide to score estimates regarding top local designers in your urban area.

However, your unique condition or city might have its very own conditions calling for just signed up builders to do particular servings away from really works (instance liquids, stamina, and you may septic) and it is important to understand regional strengthening ordinance in advance.

Delivery, Set, and Power Relationships

Since house is situated from the factory additionally the site is ready, our home could be brought and set on foundation.

This is basically the queue for everybody most other trades to go into and you may finish the power installation, hookups, sky criteria, decks, and skirting.

The thing that was just an intense piece of land a few weeks ago will start to turn into where you can find your aspirations having everything desired completely change-key and you will relocate ready.

One of the greatest explanations of numerous families choose purchase a great family this way are understanding they’ll not need to love running out of funds ahead of to be able to complete the tactics they wish to make their household getting a lot more done.

The newest residential property and you will a home loan alternative takes additional time initial ahead of relocate time, but may and build your advance payment continue into the all of the add-ons which may need decades to keep having otherwise.

When you are looking for speaking with a homes agent from the investment your own property and you may cellular home, contact us today at the 210-361-0725. We’d choose listen to away from you!